Thanks to our tax laws the government will pick up the tab for a sizable portion of your expenses while attending meetings trade shows or conventionsif you follow the rules. You must meet two conditions to take the travel expense deduction.

Routeperfect Is An Online Trip Planning Tool That Helps You Create A Custom Trip Itinerary Based On Your Travel Prefe Plan Your Trip Traveling By Yourself Trip

After 16 years and Over 100 events the Travel Adventure Show Series has connected over 21 million travel enthusiasts with over 4500 unique travel marketers in a professional setting that facilitates face-to-face conversations and has impacted over 49 billion in travel bookings.

Seminar schedule for travel expense expo. July 22 2021. The rules above also apply to corporations. CHECKLIST FOR EAP FORM.

Deducting Travel To Conferences and Seminars. This can include deductions for your transportation lodging and 50 of your meal expenses while on business. In short this category represents the cost of organizing the event attracting attendees and managing the administrative elements.

Seminars conferences and training courses. These rules apply to workshops conferences and seminars. Professional conferences broaden your expertise.

You can write off travel to business-related conventions seminars or similar meetings with the mileage deduction. Your duties must require you to be away from home your regular place of business regardless of where you maintain your family home substantially longer than an ordinary days work. Finally the tax law limits cruise ship convention deductions to only 2000 per year.

The cost of the actual travel would be the most direct route to get to the convention. He spent 5000 on business class seats 1500 on the conference and 4000 on lodging. Virtual Annual Conference 2020.

KR Library is an essential partner in driving transformation and development for individuals organisations and academic libraries. Make a Seminar Inquiry -- Eastern Region. Please attach schedule reflecting dates and credits and account.

This summer Jason is planning to travel to Spain for a five day conference followed by five days of vacation. Expenses include those for ordinary and necessary travel away from home for your business. You can deduct your travel expenses including travel lodging and meals for yourself when you attend a convention within the United States if you can show that attending the convention benefits your business.

FY 2021 BIS Seminar Schedule Print Subject to Change Dates. BusinessWorkplace Ethics - Online 247 Self-Paced Training. The costs you can claim include fares to attend the venue where the seminar conference or training.

Consider items and their average pricing. Travel and Tour Management Program 3 Days To Be Announced. ATTENDANCE AUTHORIZATION Attendance by Elected Officials at any conference seminar or other business travel requires Council Approval where applicable.

Production includes all of the staff and resources required to plan and execute the event. Production Expenses. If the travel requires a layover to meet with family for example this portion should be reasonably considered personal in nature and removed from the total expense.

Home Seminar Schedule Human Resource Management and Training. Generally all that is required in order to qualify for convention-related tax deductions is that you be able to show if asked that attendance at the trade show. When Jason is ready to file his taxes he should deduct the full 1500 for his conference but prorate his flight and hotel based on the number of.

You can claim the cost of attending seminars conferences or training courses to maintain or increase the knowledge capabilities or skills you need to earn your income in your current employment. Employee spending is classed as a miscellaneous 2 percent expense You add all such expenses together and subtract 2 percent of your adjusted gross income. PAYMENT FOR THE SEMINAR AND TIME IN THE SEMINAR.

Make sure your colleague mentions your name upon ordering so that you will receive this special thank you check. BISCensus AES Compliance Training. Complete Prior to Travel.

This is considered part of the regular duties normally imposed upon employees and if the employer requires attendance the employer must pay. NON-MC COURSES SEMINARS CONFERENCES OR WORKSHOPS. At Travel Medical Seminars we appreciate each and every referral and will thank you with a 50 check when your referred colleague who is new to Travel Medical Seminars signs up for hisher first seminar with us.

Each year Americas most avid travelers flock to their. Contact a Counselor -- Eastern Region. 700 per person for a three-day event see breakdown below Travel expenses for additional staff VIPs keynote speakers and presenters are a big part of your event budget yet these expenses are easy to overlook and underestimate.

When youre an employee you can deduct travel costs for a business conference but only if you itemize on Schedule A and only those costs that your employer didnt reimburse. By Stephen Fishman on November 3 2016 in Mileage. Note this is not necessarily true for.

How to Start and Manage a Preschool or Day Care Center. Travel expenses and hotel accommodations Estimated cost. A Travel Expenses form must be completed and authorized.

Providing practical and solutions-based information from leading authors and contributors in emerging markets. These expenses begin the moment the event is dreamed up and continue through the post-event paperwork. The employer is required to pay for the cost of the education and for employees work time attending the seminar.

Estimated Expense Lodging This area is for travel fees only. This section provides the guidelines for travel for attendance at Conferences Seminars and Special Events. While receipts for expenses of 75 or less are not required when attending a.

Your search for travel entertainment expenses reimbursements policy policies training seminars workshops and conferences in US and Canada has produced the following results.

Crafting To Disney Whatever Wednesday Rundisney 2015 2016 Schedule And Training Update Run Disney Disney Half Marathon

Staggering Trade Show Statistics Skylineexhibits Infographic Trade Show Trade Show Exhibit Trading

Shuba1688 Com Nbspthis Website Is For Sale Nbspshuba1688 Resources And Information Expense Management Concur Traveling By Yourself

Content Marketing Calendar Examples 8211 Ajak Ngiklan Content Marketing Calendar Marketing Calendar Digital Content Marketing

The Terrific Expense Report Template For Mac Numbers Travel Excel 2007 Regarding Gas Mileage Expense Repor Word Microsoft Book Report Templates Report Template

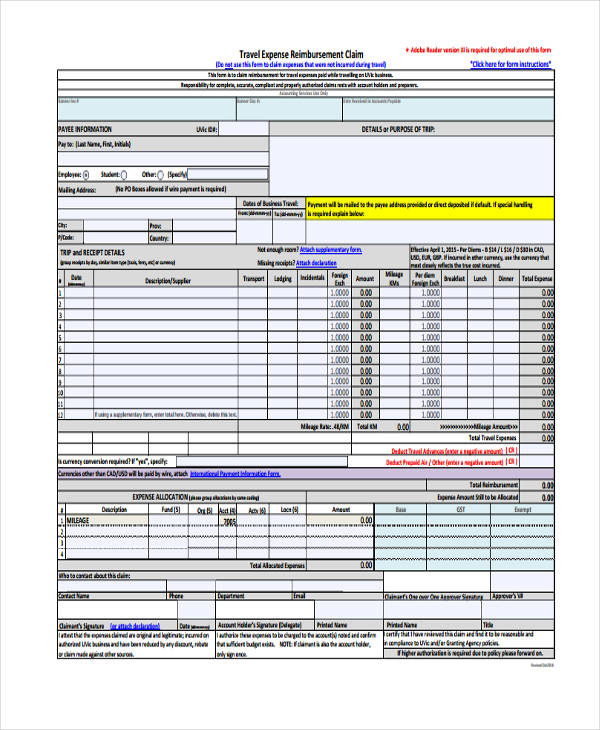

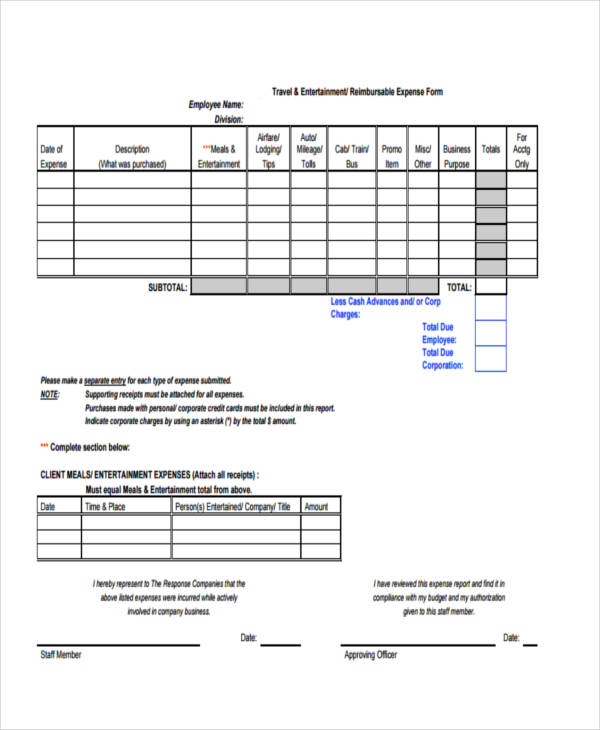

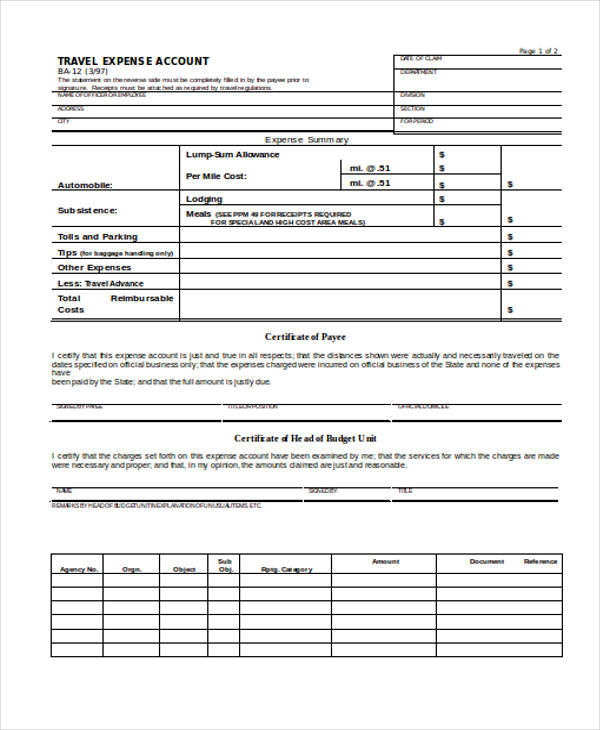

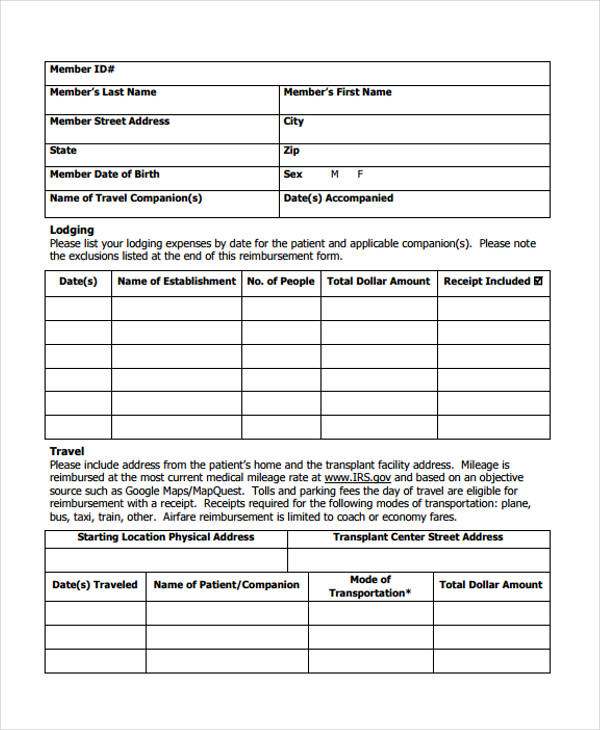

Free 38 Travel Forms In Pdf Excel Ms Word

Free 38 Travel Forms In Pdf Excel Ms Word

There Are Risks And Costs To A Program Of Action But They Are Far Less Than The Long Range Risks And C Performance Quote Image Quotes Online Training Business

Free 38 Travel Forms In Pdf Excel Ms Word

Absolute Exhibits Trade Show Planning Timeline Want More Trade Show Help Download Our Guide Trade Show Exhibition Plan Trade Show Display

Want To Work From Home Learn How To Get A Remote Job In 2020 Today It S A Travel O D Remote Jobs Work Skills Job Training

Travel Expense Report Template Report Template How To Make Notes Templates

How Much Will Artists Be Paid Under The New W A G E Certification Program Artistic Space Artist Certificate

Look Who S Talking When The Travel Bug Bites Speech Language Pathology Travel Opportunities Speech And Language Speech Language Pathology Pathology

Free Educational Seminar For Realtors We Would Like To Invite You To Our Free Educational Seminar Event Real Estate Classes Mortgage Payoff Being A Landlord

Free 38 Travel Forms In Pdf Excel Ms Word

Hr Budget Template Budget Template Hr Department Budgeting

Travel Trade Meaning Event Planning Business Financial Seminar Best Travel Sites

Learning How To Get That Internship At The Intern Expo At Spcollege Epicenter Home Home Decor Room